What is Earned Value Management?

EVM is a method for measuring project performance. It compares what is actually happening on the project against the approved baselines and helps us to answer questions such as:

- Where are we on the project money and time wise?

- Will we make it within budget and schedule?

- What do we need to do to get back on track?

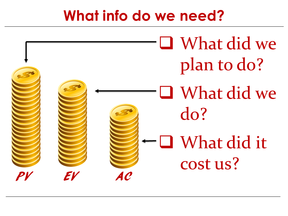

| To determine this we need:

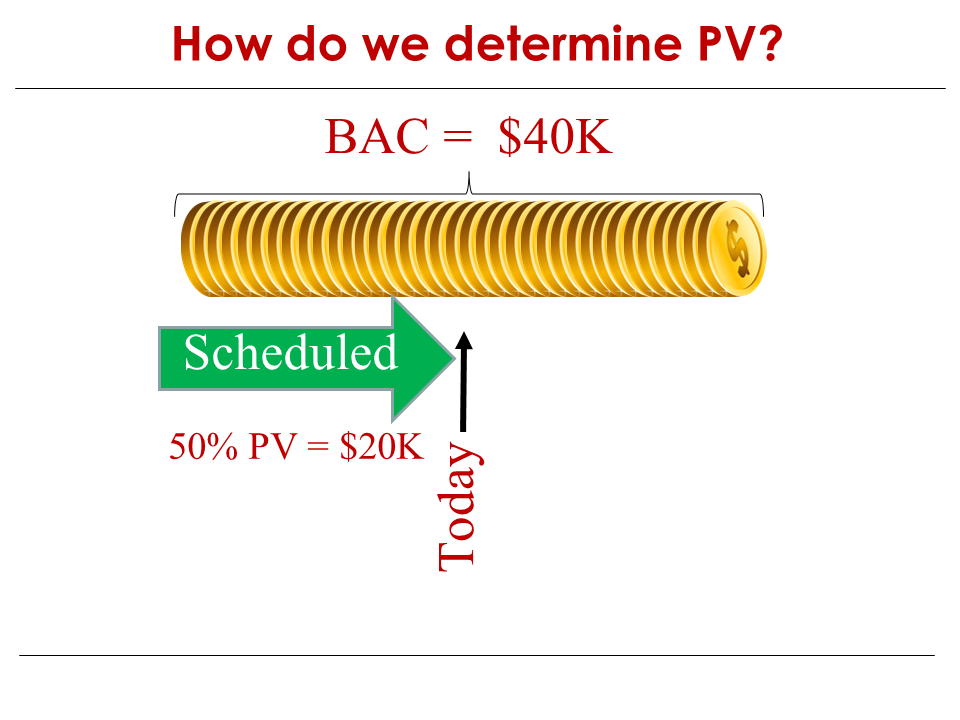

Let’s assume that we have an activity that we estimate will cost $40K to complete. (BAC). Let’s also assume that we have only scheduled 25% of the activity to be done by the reporting date. The PV will then be 25% of the BAC, which is 25% of $40K = $10K. |

We need to know what portion of the project is scheduled to be completed by the reporting date – normally referred to as “today”.

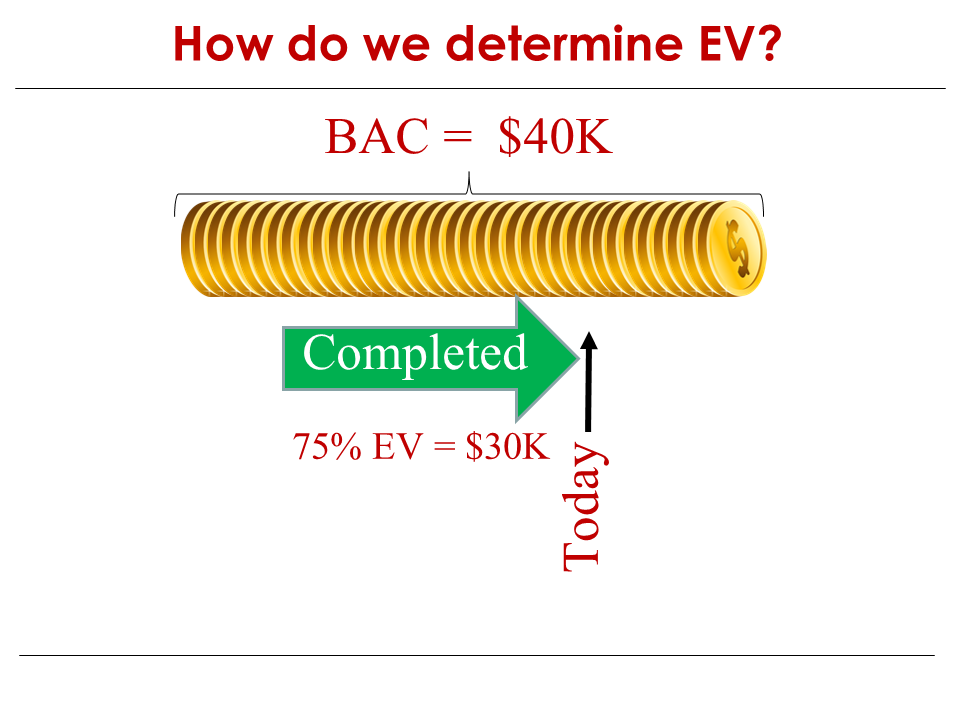

EV is also based on the BAC of the activity. EV is determined by calculating what portion of the BAC has been done, irrespective of what portion was scheduled to be done.

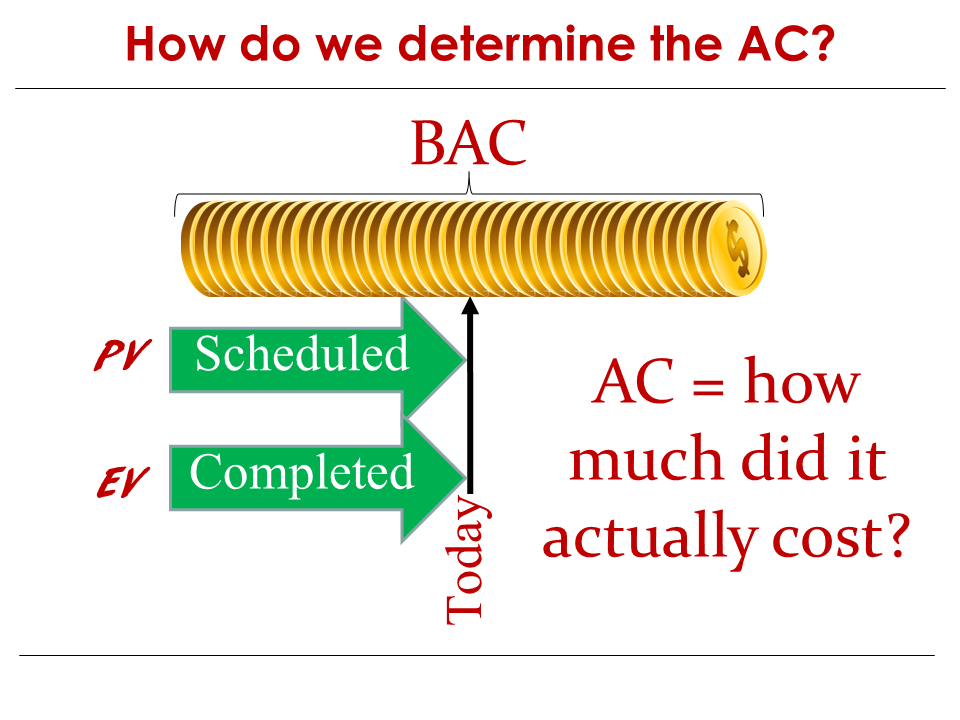

How do we determine Actual Cost?

| The Actual Cost is the amount that it actually cost to do the work that was done to date. AC is not based on BAC. AC does not depend on what portion was scheduled (PV). AC is influenced by EV in as far as that there should not be a value for AC if EV is zero, in other words only when some work is done there should be values for AC and EV although these two values can differ vastly as AC can be less, the same as or more than the EV amount. |

How do we calculate the variances on the project? In other words how do we determine how our time and cost performance measures against our baselines? Let’s assume that we have a project with the following measurements: We have planned to do $40K worth of work (PV), we have done $40K worth of work (EV), and it actually cost us $40K to do the work (AC).

Even without the use of formulas we can see that in this example the project is exactly on schedule and on budget, but let us look at the variance formulas.

What will the schedule variance (SV) be? SV is determined by comparing what we have done (EV) with what we have planned to do (PV). Therefore SV = EV – PV. In this example SV = $40K -$40K and that equals 0. In other words no schedule variance as we are on schedule.

How would we determine the cost variance? CV is determined by comparing what we have done (EV) with what it cost us to do it (AC). Therefore CV = EV – AC. In this example CV = $40K - $40K and that equals zero indicating that we have no cost variance as we are exactly on budget.

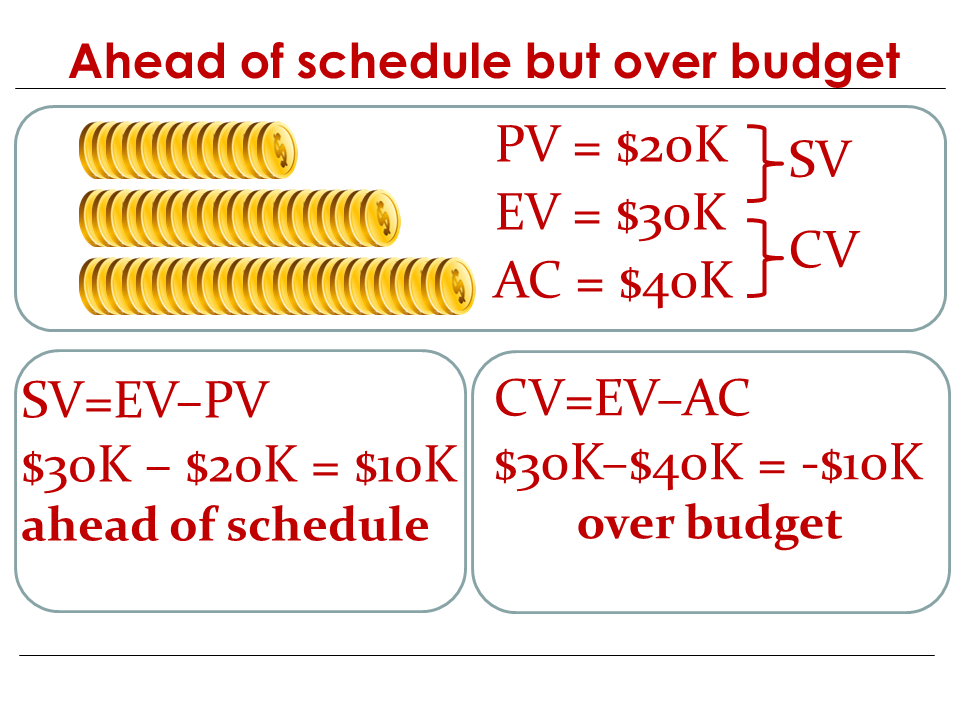

| Let’s now assume that we have a project where we:

In this case the SV = $30K (EV) - $20K (PV) that gives us $10K indicating we are ahead of schedule. The CV = $30K (EV) - $40K (AC) that gives us minus $10K indicating that we are over budget. |

Let’s assume again we have a project where the PV, EV and AC are exactly the same on $40K. From the variance analysis we saw that the project was on schedule and on budget. For calculating indices we again only use PV, EV and AC – but as we are now looking at the relationship between them and not the variance, we divide EV by PV for the Schedule Performance Index (SPI) and divide EV by AC for the Cost Performance Index (CPI). Here we see that SPI = EV / PV and that gives us $40K / $40K = 1. A SPI of 1 means that our schedule progress on the project is exactly as we have planned. Therefore we are progressing at 100% of the rate scheduled. CPI = EV / AC and that gives us $40K / $40K = 1. A CPI of 1 means that for every $1 we invest in the project we are making $1 worth of progress. Therefore we are exactly on budget

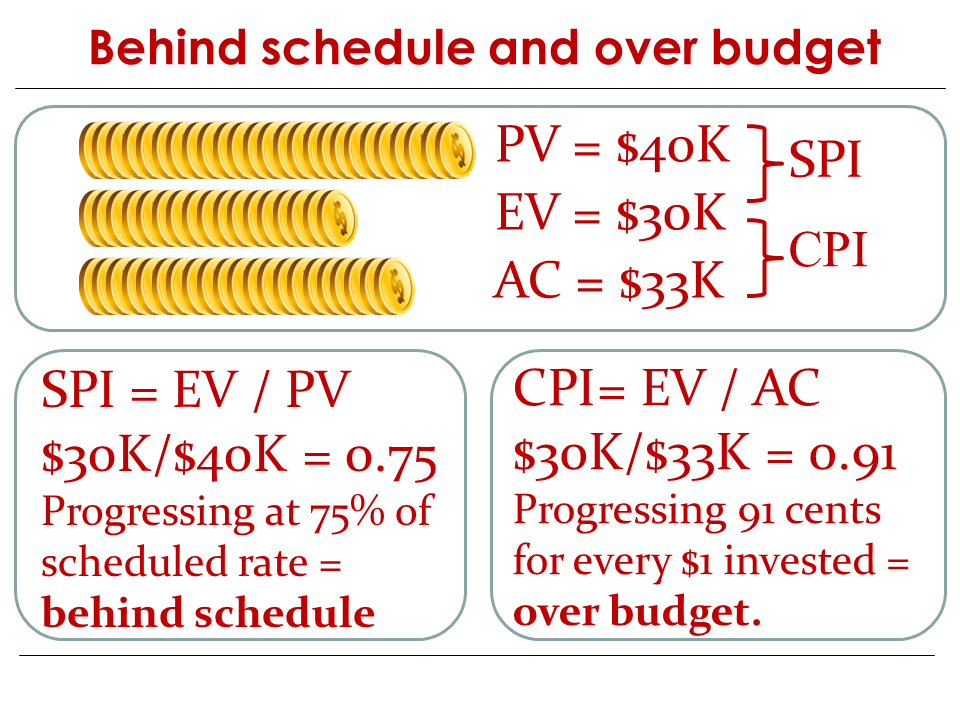

| Let’s assume that the measurements on our project are now PV = $40K, EV = $30K and AC = $33K. The SPI = EV / PV. Therefore it is $30K / $40K = 0.75. The SPI of 0.75 indicates that we are only progressing at 75% of the rate as per the authorised schedule. We are therefore behind schedule. The CPI = EV / AC. Therefore it is $30K / $33K = 0.91. The CPI of 0.91 indicates that for every $1 we invest in the project we are only progressing 91 cents worth of work. We are therefore over budget. |

The most commonly used forecasts are:

- ETC – how much money do we need to complete the rest of the project?

- EAC – how much will the project cost us in total?

- VAC – how much will we be over or under budget at the end of the project?

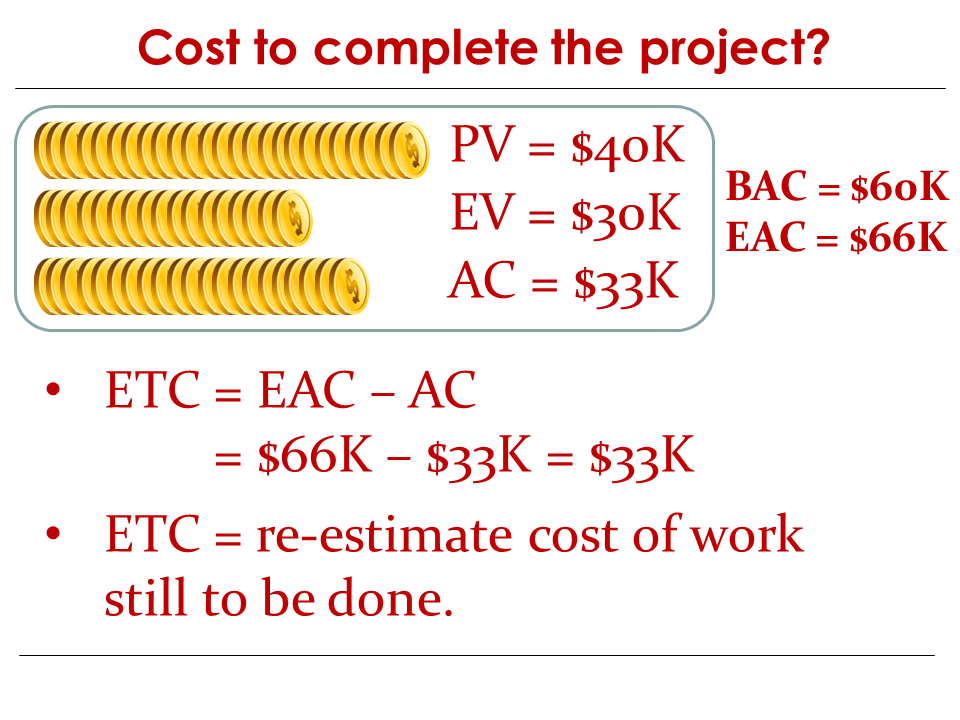

How do we determine the Estimate to Completion?

| The Estimate to Completion (ETC) is a forecast of how much money we need to complete the project. If we have a forecast of how much money the project is going to cost in total (the EAC figure), we can subtract how much we have already spent on the project. In other words ETC = EAC – AC. We will see just now that there are various ways we can forecast the value of EAC. |

Another way is to re-estimate all the work that still needs to be done on the project. This can be more accurate but also a much more time consuming estimate. Should we not have enough of the original budget left to cover the forecasted ETC, we will have to decide what corrective actions are required, if any.

How do we determine the Estimate at Completion?

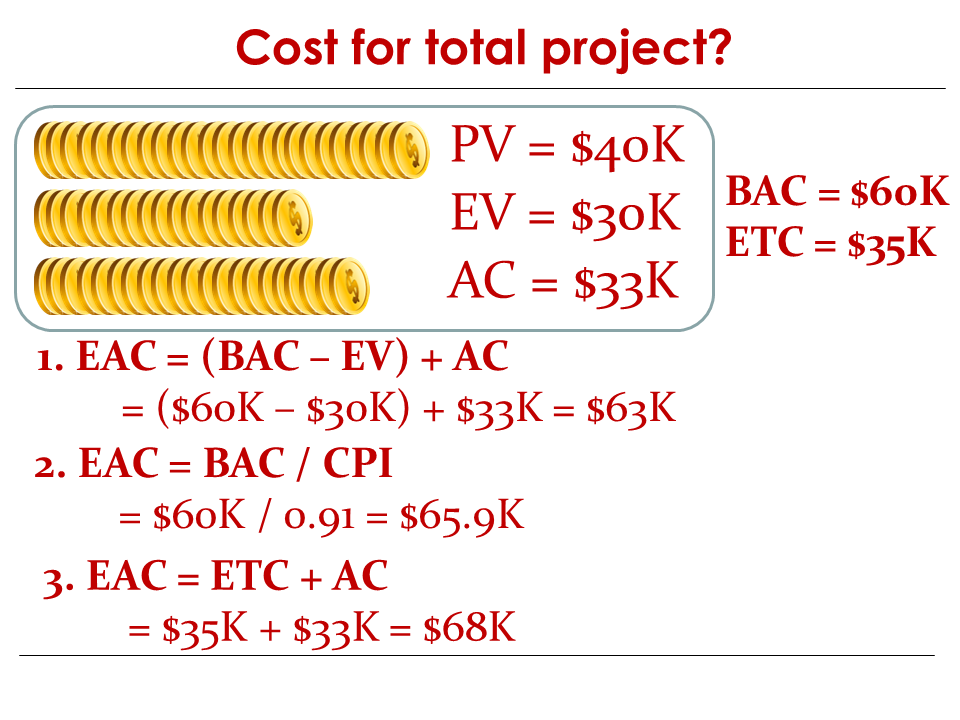

The Estimate at Completion is a forecast of how much we at this stage estimate the total project will cost. One way to calculate EAC would be to determine what the estimated worth of the uncompleted tasks are (BAC – EV) and then add what we have already spent on the project (AC) to that. That would give us a formula where EAC = (BAC – EV) + AC.

| In the example BAC = $60K, EV = $30K and AC = $33K. Therefore EAC = ($60K – $30K) + $33K = $63K. This method assumes that all uncompleted work will be done at the budgeted rate in other words the future CPI will be 1. Calculating EAC = BAC / CPI is also frequently used and here it is assumed that what we have experienced on the project to date will continue into the future. This method gives an EAC of $65.9K. |

If we know what ETC is we can add what we have already spent (AC) to the ETC to arrive at a forecasted EAC. Let us assume that we re-estimated the ETC to be $35K and AC is $33K. Therefore we will forecast an EAC of $68K for the project.

As previously stated re-estimating the ETC can be more accurate but also more time consuming. This method takes our experiences on the project to date into account and the forecasted ETC also takes applicable risk responses and corrective actions into consideration.

How much will the budget to be over or under (VAC)?

Variance at Completion, what we normally refer to as how much will we be over or under budget at completion, is calculated by subtracting EAC from BAC. Therefore VAC = BAC – EAC. The forecasted value of the VAC will obviously depend on our forecasted value of EAC. If for example BAC = $60K and EAC = $68K then VAC = $60K (BAC) - $68K (EAC) indicating that we forecast the project to exceed the approved budget by $8K. Using one of the other methods to calculate the EAC, we will obviously calculate a different value for VAC.

Please take note that there are much more to EVM – this discussion only covered the most basic aspects.

RSS Feed

RSS Feed